|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding Home Interest Rates: A Comprehensive GuideHome interest rates play a crucial role in the process of buying a home or refinancing an existing mortgage. They can significantly impact your monthly payments and the overall cost of your loan. Factors Influencing Home Interest RatesEconomic IndicatorsInterest rates are influenced by various economic indicators such as inflation, unemployment rates, and the Federal Reserve's monetary policy. Credit ScoreYour credit score is one of the most critical factors lenders consider when determining your interest rate. A higher credit score usually translates to a lower interest rate.

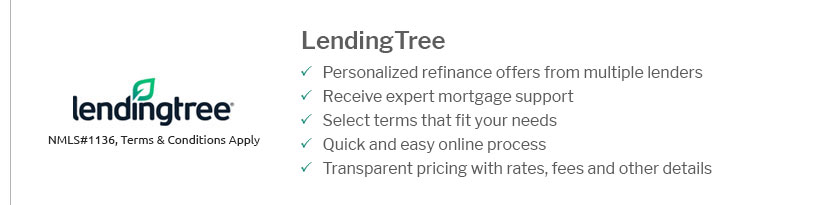

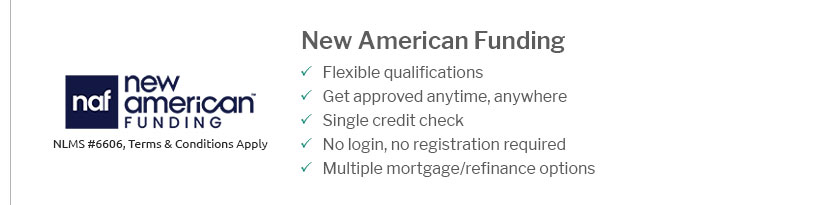

Types of Home Interest RatesFixed-Rate MortgagesFixed-rate mortgages offer a stable interest rate for the duration of the loan term, making budgeting easier. Adjustable-Rate Mortgages (ARMs)ARMs typically start with a lower interest rate, which can adjust periodically based on market conditions. This option can be appealing but carries the risk of increased payments over time. Comparing LendersChoosing the right lender is essential to securing the best interest rate. Consider exploring options from various lenders, including best direct mortgage lenders, to find competitive offers.

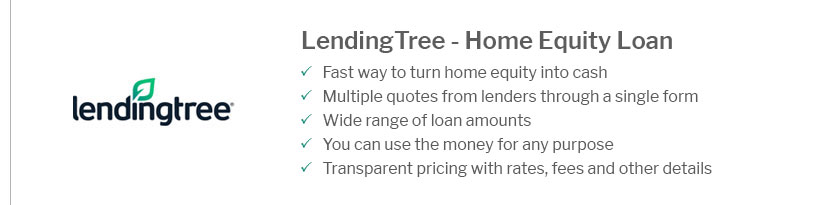

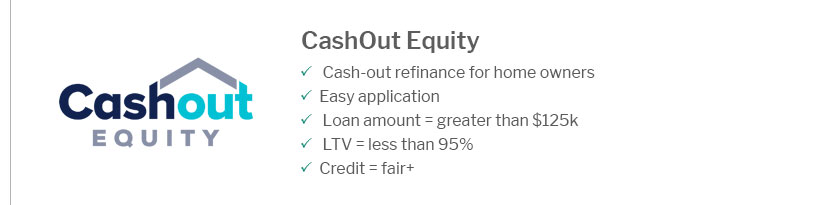

Refinancing Your MortgageRefinancing can be a strategic move to lower your interest rate and reduce monthly payments. It's important to compare refi interest rates to ensure you are getting the best deal possible. When to RefinanceConsider refinancing when interest rates drop significantly below your current rate or when your credit score has improved. FAQWhat is a good home interest rate in 2025?A good interest rate varies based on market conditions, but generally, anything below 4% is considered favorable in 2025. How do I improve my chances of getting a lower interest rate?Improving your credit score, maintaining a stable income, and providing a substantial down payment can enhance your chances of securing a lower interest rate. Are there any risks associated with adjustable-rate mortgages?Yes, the primary risk is that your monthly payments could increase significantly if interest rates rise after the initial fixed period. https://www.bankrate.com/mortgages/mortgage-rates/

For homeowners looking to refinance, the current average interest rate for a 30-year fixed refinance is 6.75%, rising 3 basis points compared to this time last ... https://www.freddiemac.com/pmms

The 30-year fixed-rate mortgage ticked down by two basis points this week. Recent mortgage rate stability continues to benefit potential buyers this spring, as ... https://www.bankatfidelity.com/rates/mortgage-rates/

*Please note that the interest rate and fees shown here are available to borrowers with an excellent credit history. Rates reflect a loan ...

|

|---|